As reported by VCAOnline, Cambridge Associates, LLC, for the quarter ending March 31, venture capital funds continue to rebound with eight quarter string of positive gains. Although their returns still lag those of private equity funds for the most recent five and 10-year periods, their recent quarterly gains have grown by a wider margin. While this is good news for the recovering venture capital industry, it is likely to increase the attention the industry is receiving from tax-hike advocates in Congress which may mean bad news when it, once again, takes up the issue of taxing carried interest at ordinary income tax rates.

The recently brokered debt hike deal in Congress provided interim relief for the industry when both sides agreed to exclude any type of tax hike from the legislation. But, as the industry’s fortunes continue to improve, it will likely widen the chasm between the tax hikers and the tax cutters. We can expect the carried interest controversy to be at the center of the debate at least through the time that the current, more favorable 15% rate is scheduled to sunset at the end of 2012 along with the Bush tax cuts.

tax hike from the legislation. But, as the industry’s fortunes continue to improve, it will likely widen the chasm between the tax hikers and the tax cutters. We can expect the carried interest controversy to be at the center of the debate at least through the time that the current, more favorable 15% rate is scheduled to sunset at the end of 2012 along with the Bush tax cuts.

The two main arguments for and against changing carried interest taxation will continue to hinge on whether it should be treated as compensation or investment income. As long as the administration continues to target “millionaires, billionaires, corporate jet owners and hedge fund managers”, carried interest will be in play. And, if the Tax Courts intervene in the interim, as they have just recently, the case against carried interest tax hikes could be weakened further.

The venture capital industry is taking a hard look at its compensation structure in view of the worst case scenario. Some industry observers see the firms moving away from carried interest or restructuring it into some sort of loan arrangement to get around tax issues. Such moves can only increase scrutiny and draw the ire of Congress. In the time the industry has before the issue is firmly on the chopping block, it could consider viable alternative arrangements that retain the investment risk incentive while applying a fair tax structure to all of its compensation components. One suggested approach is to treat carried interest in much the same way as restricted stock, whereby the initial distribution is taxed as ordinary income while future distributions are treated as appreciation subject to capital gains.

The bottom line is that the final outcome is far from being determined. Depending on how far both sides of the issue are willing to go to achieve their ends, the outcome is certain have an enduring impact on the future capital funding.

{ 3 comments }

i love your blog, especially the insight into carried interest. thanks.

– Jamie

I needed to thank you for this post. Still more regulation to come regarding carry, I’m sure. And why not? PE pros should pay their fair share.

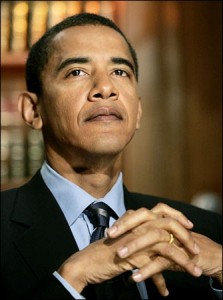

When will Obama’s crew ever stop??? Private Equity and small business are the keys to getting the US back on track.

Get a clue, Barack.